tn franchise and excise tax exemption

A franchise tax is a tax for having the right to do business in Tennessee. Franchise Excise Tax - Excise Tax All persons except those with nonprofit status or otherwise exempt are subject to a 65 corporate excise tax on the net earnings from business.

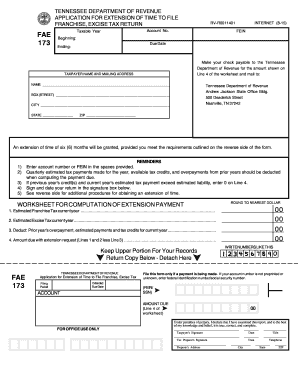

Tn Dor Fae 173 2015 Fill Out Tax Template Online

The form on the reverse side should be completed.

. A completed franchise and excise tax return FAE170 must be filed electronically with a minimum 100 payment of any taxes due by the 15th day of the fourth month following the. Next if you dont file the proper exemption a Tennessee LLC is subject to a franchise and excise tax for the privilege of doing business in their State. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered.

TENNESSEE DEPARTMENT OF REVENUE RV-R0012201 1121 Franchise and Excise Tax Application for ExemptionAnnual Exemption Renewal FAE 183 Check all that apply. Youre only loking at 43 at the top end of that bracket -. Thank you for submitting your Franchise and Excise Tax Annual Exemption Renewal FAE 183 online at Tennesseegov.

A franchise and excise tax credit is available for tax years beginning on or after July 1 2021 for qualified payroll expenses incurred by taxpayers engaging in qualified productions in. A completed franchise and excise tax return FAE170 must be filed electronically with payment of any taxes due by the 15th day of the fourth month following the close of the. FE-9 - Extension for Filing the Franchise and Excise Tax Return To receive a six month extension a taxpayer must have paid on or before the original due date an amount.

Self employment tax is really only the other 75 that the employer pays - a normal w2 job already deducts the employee side of the 75. ET-1 - Excise Tax Computation. The excise tax is based on net earnings or income for the tax year.

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. FONCE-1 - Qualification and. Unlike other taxes a business does not need to have a profit or sales to owe a franchise tax.

To qualify for the franchise and excise tax venture capital fund exemption the venture capital fund must be a limited liability company limited liability partnership limited. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. The excise tax is based on net earnings or income for the tax year.

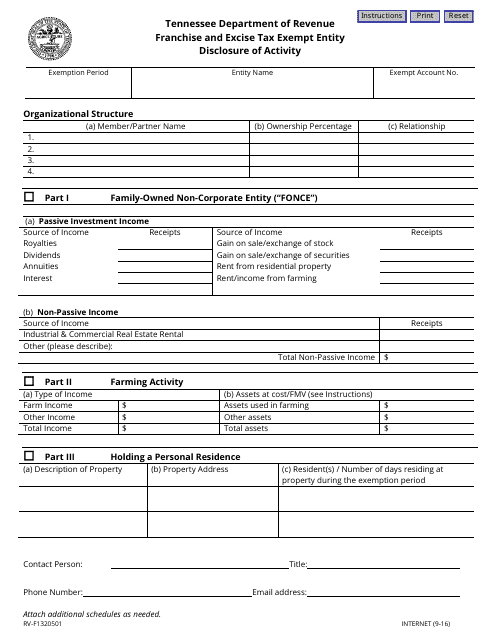

Please mail completed applications and annual renewals to. You can read frequently asked questions about the Family Owned Non-Corporate Entity Exemption FONCE exemption for franchise and excise tax here. Tennessee Code Annotated Section 67-4-2008 provides exemption from Tennessees Franchise and Excise Taxes under certain situations.

How much is the franchise tax in. Your confirmation details are below. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered.

The taxpayers initial franchise and excise tax exemption application and all subsequent exemption renewal applications should be submitted on or before the 15th day of. All entities doing business in Tennessee and having a substantial nexus in. This potential negative tax effect can be avoided for an affiliated group by making a joint election to compute net worth on a consolidated basis.

Tennessee Franchise Excise Tax Price Cpas Box 1300 Charlotte NC 28201. The excise tax is 65 of the.

Restauranteur Says Rep Hill Tax Forbearance Measure Would Be Welcome Wjhl Tri Cities News Weather

Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal Due The 15th Day Of The Fourth Month Following The Close Of Your Books And Records

Tennessee Franchise Excise Tax Price Cpas

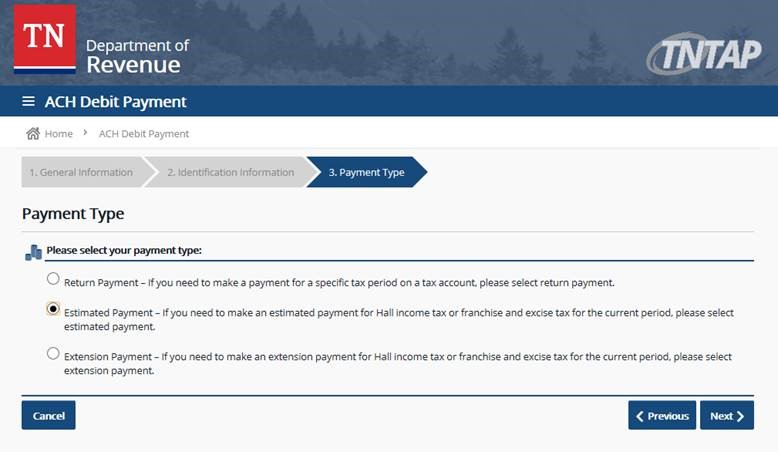

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Fae 170 Fill Out Sign Online Dochub

Tennessee State Tax Updates Withum

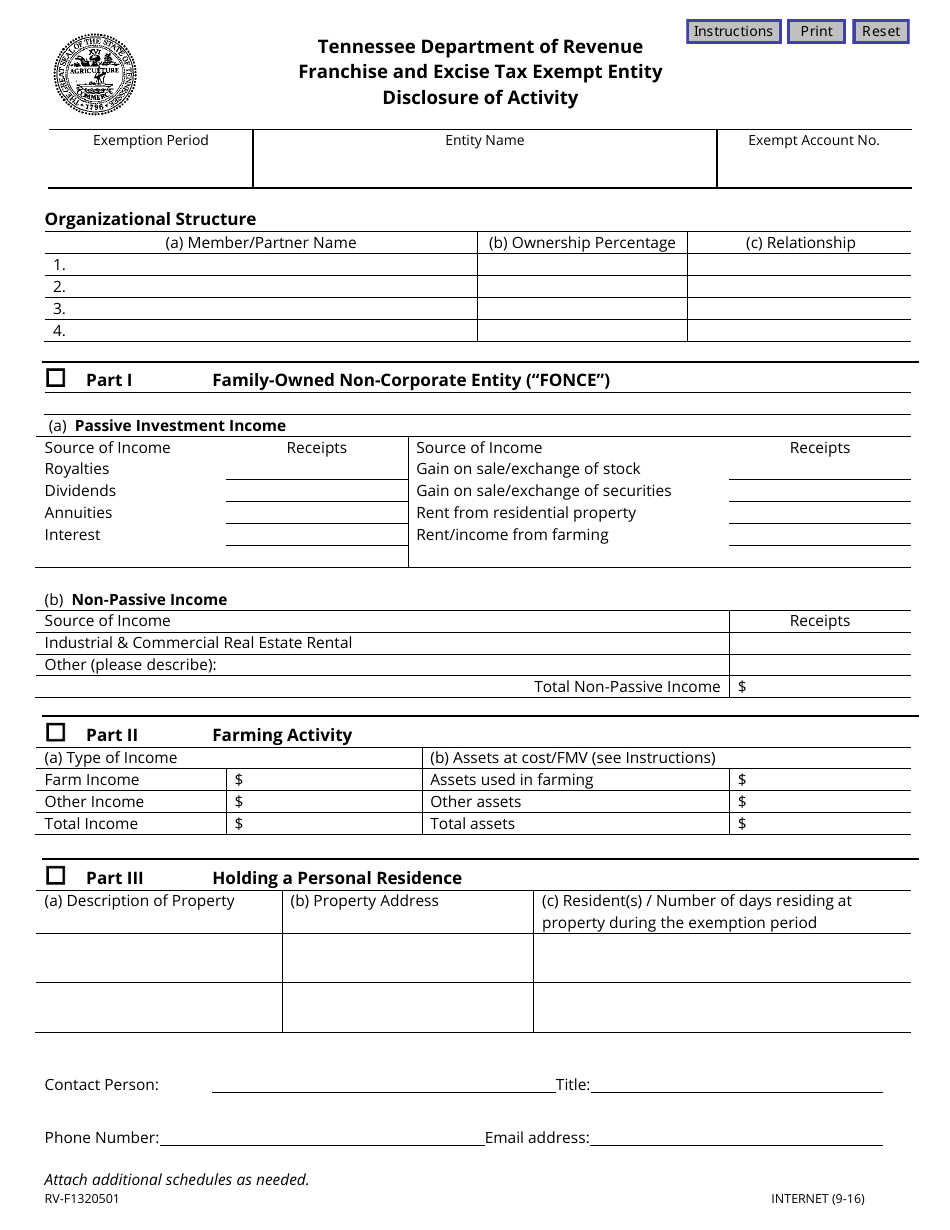

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

Tennessee Allows Annualized Method To Determine Excise Tax Estimated Payments Kraftcpas

Presented By Leslie S Maclellan Maclellan Law Pllc Formation Of For Profit And Not For Profit Entities C 2012 Chambliss Ppt Download

Welcome To Town Of Arlington Tennessee

Tennessee Creates New Tax Benefits For The Film And Television Industry Pillsbury Seesalt Blog Jdsupra

Form Rv F1320501 Download Fillable Pdf Or Fill Online Franchise And Excise Tax Exempt Entity Disclosure Of Activity Tennessee Templateroller

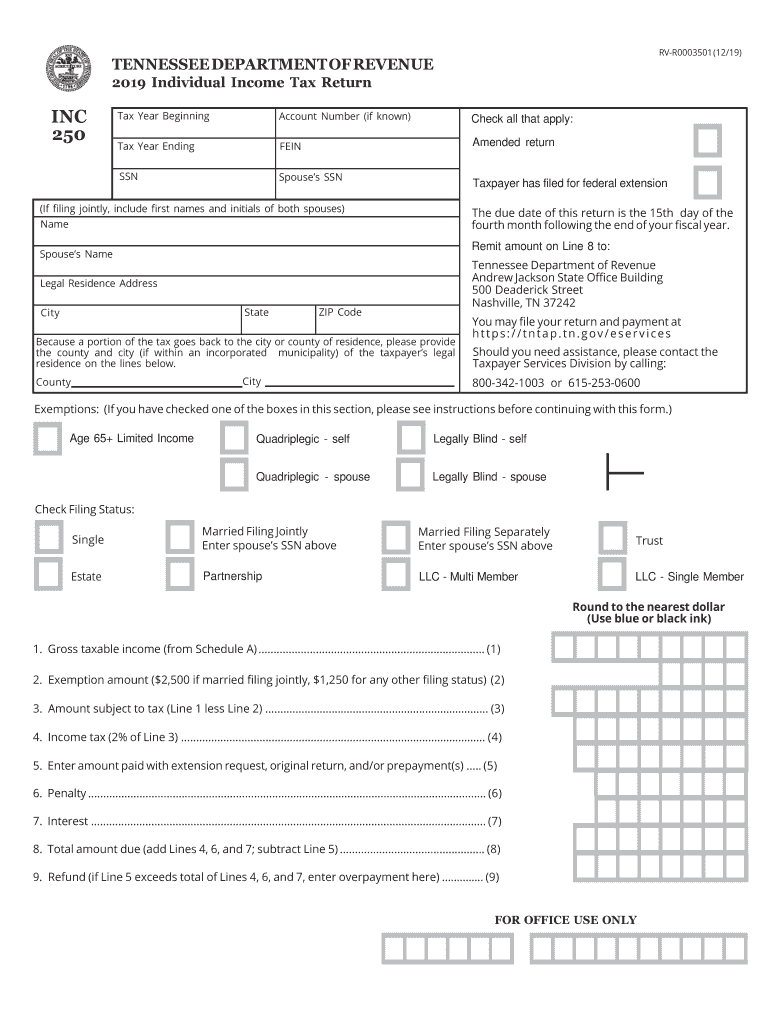

Fillable Tn Form Nc 250 Fill Out Sign Online Dochub

Tennessee Form Fae 183 Franchise And Excise Tax Annual Exemption Renewal 2021 Tennessee Taxformfinder

Tennessee Franchise And Excise Tax Exemption Fill Online Printable Fillable Blank Pdffiller

How To Form An Llc In Tennessee Llc Filing Tn Swyft Filings

Tennessee Department Of Revenue Application For Registration Sales And Use Tax Exempt Entities Or State And Federally Chartered Credit Unions Tennessee Fill Out Sign Online Dochub